1. Understanding the Management of ROBOT PAYMENT

2. Business Overview

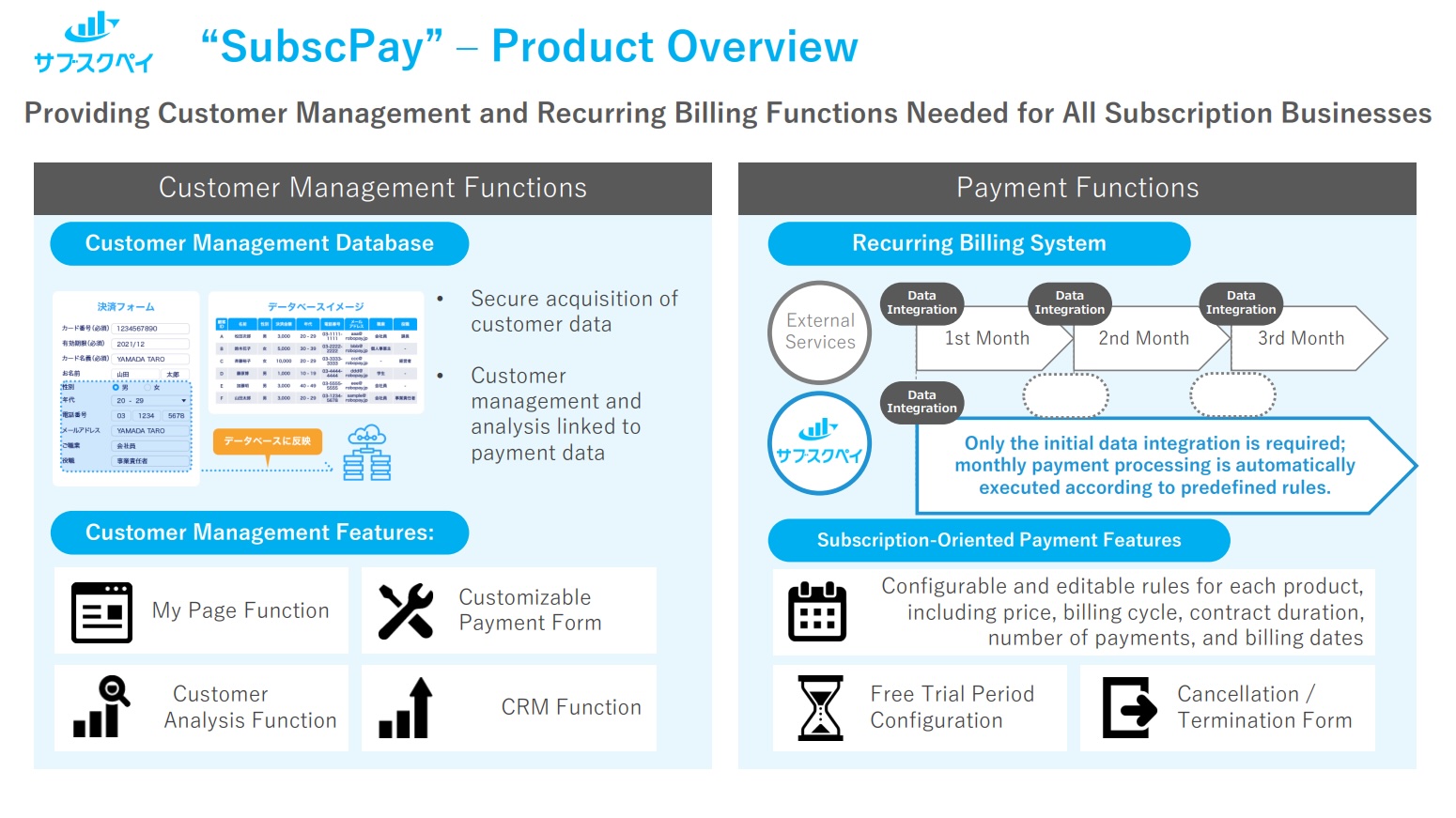

Subscription Pay

"Subscription Pay" is a customer management and automatic payment solution specialized for B2C and

B2B subscription businesses, offered as an internet payment processing service since our founding in

2000.

We connect businesses and merchants seeking to use payment services with payment providers such as

credit card companies and banks, offering a unified platform for payment processing, customer

management, and billing systems.

Our solution stands out for its all-in-one functionality—from website creation, customer information

collection, payment processing, plan changes, to cancellations.

We provide low-cost, speedy implementation support for launching new businesses and services

quickly, while also delivering highly customizable features that grow with our clients’ businesses.

This helps reduce workload and human error, and strongly supports clients’ business expansion.

Seikyu Kanri Robo

"Seikyu Kanri Robo" is a B2B invoicing and accounts receivable management system launched in 2015.

It reduces invoicing workloads by approximately 80% by automating the entire process—from invoice

issuance, collection, reconciliation, to reminders.

This system minimizes the workload of accounting departments and reduces credit risk.

It offers a wide range of payment methods—such as credit card payments, direct debit, and bank

transfers—with low transaction fees, enhancing companies’ competitiveness by efficiently handling

rapid increases in customers and invoice volume.

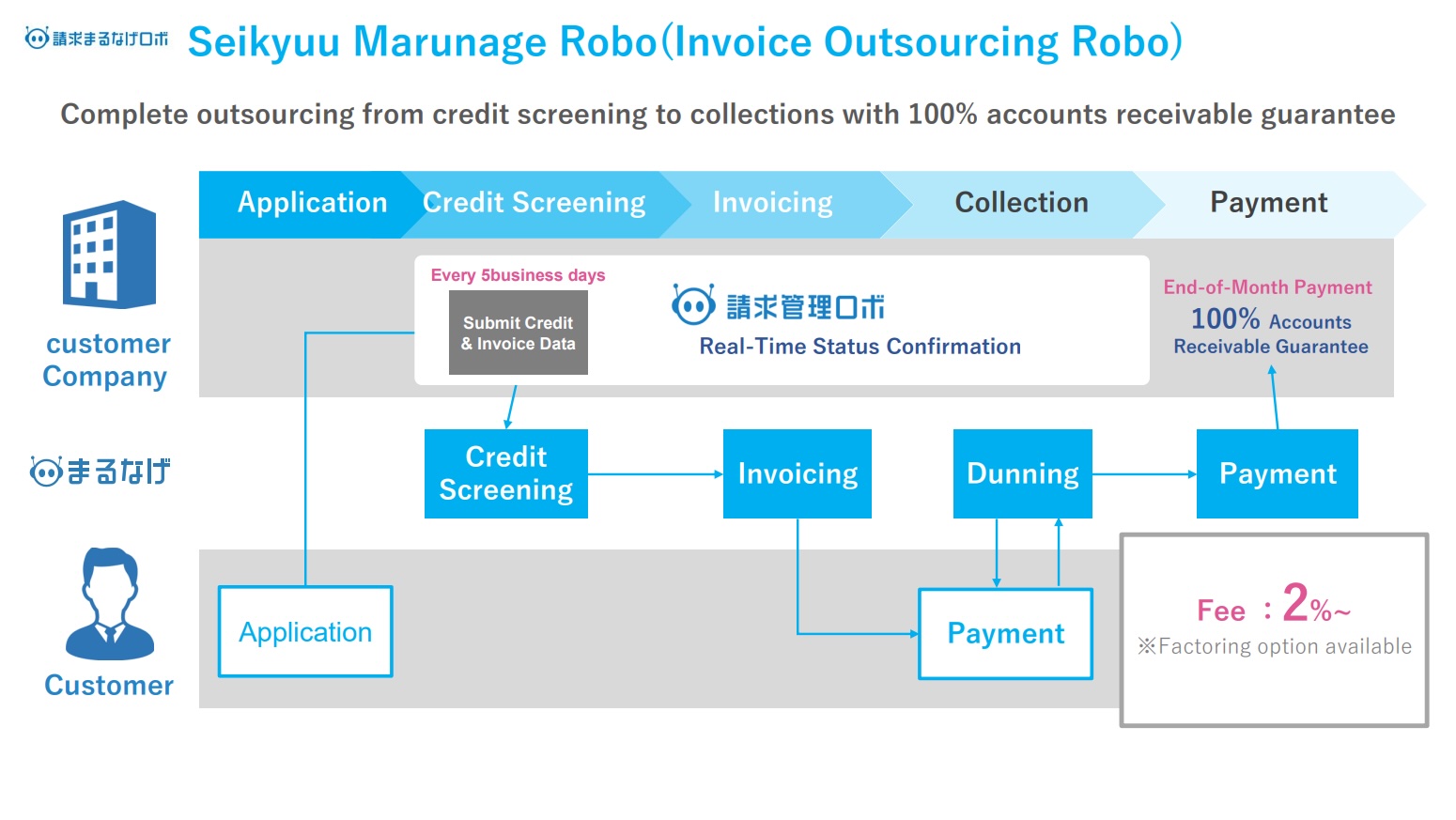

Seikyu Marunage Robo

"Seikyu Marunage Robo" is a B2B service launched in 2019 that fully outsources invoicing operations

to support companies in improving cash flow.

We handle the entire invoicing process—from credit screening, invoice issuance and delivery, payment

reconciliation, to reminders.

With 100% accounts receivable guarantee, it eliminates the risk of uncollected payments, enabling

stable cash management.

It can be smoothly integrated with both new businesses and existing invoice operations (billing,

collection, reconciliation, reminder), and solves internal inefficiencies where departments cannot

complete invoicing on their own.

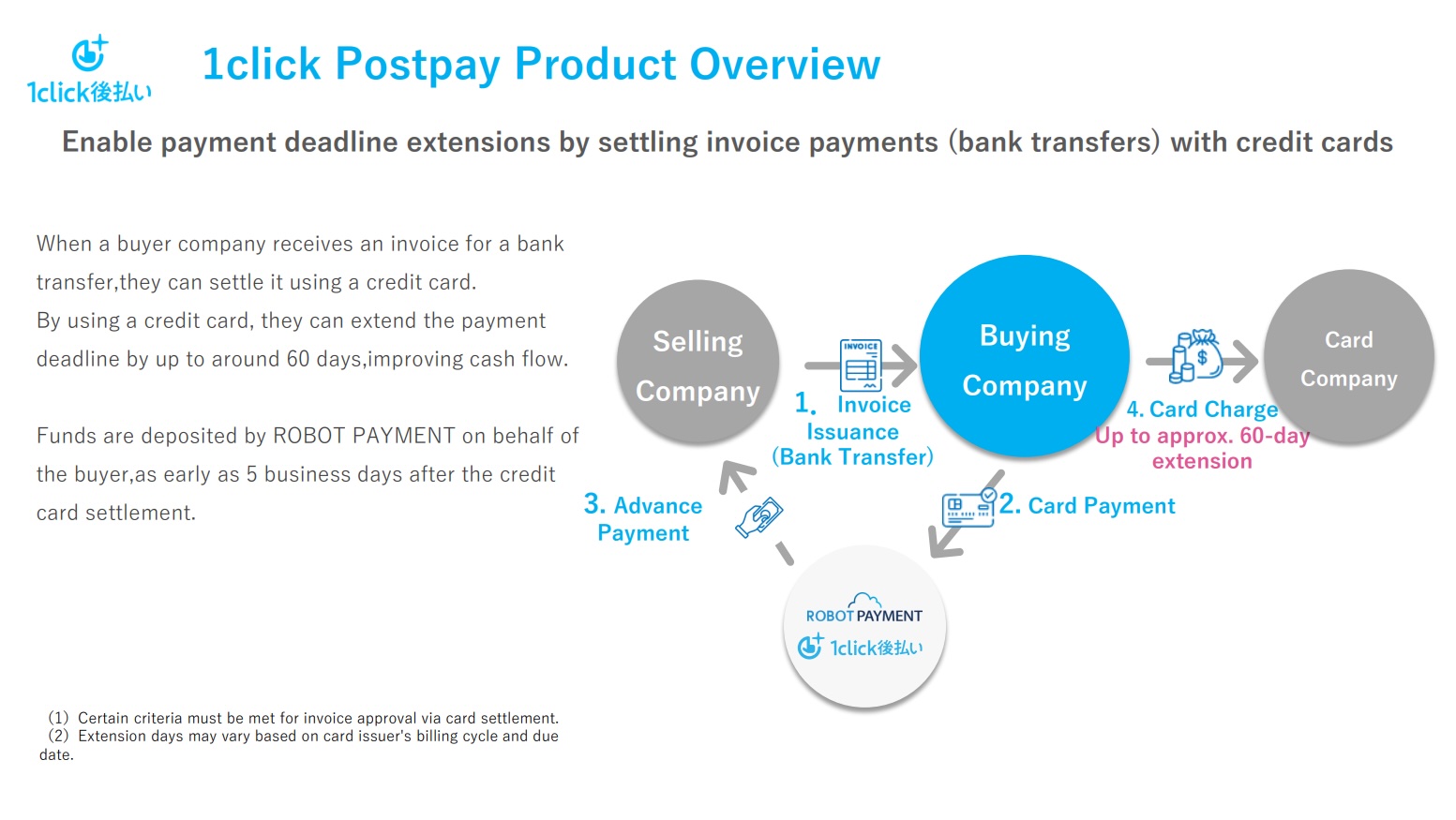

1Click Postpay

"1Click Postpay" is a B2B BNPL (Buy Now, Pay Later) service based on credit card payments, launched

in 2022.

After the buyer receives a bank transfer invoice issued by the seller, they can choose to pay by

credit card.

ROBOT PAYMENT pays the invoice amount to the seller on behalf of the buyer, and the buyer’s cash

outflow is deferred up to 60 days, depending on the credit card billing cycle. This service helps

improve buyers’ cash flow.

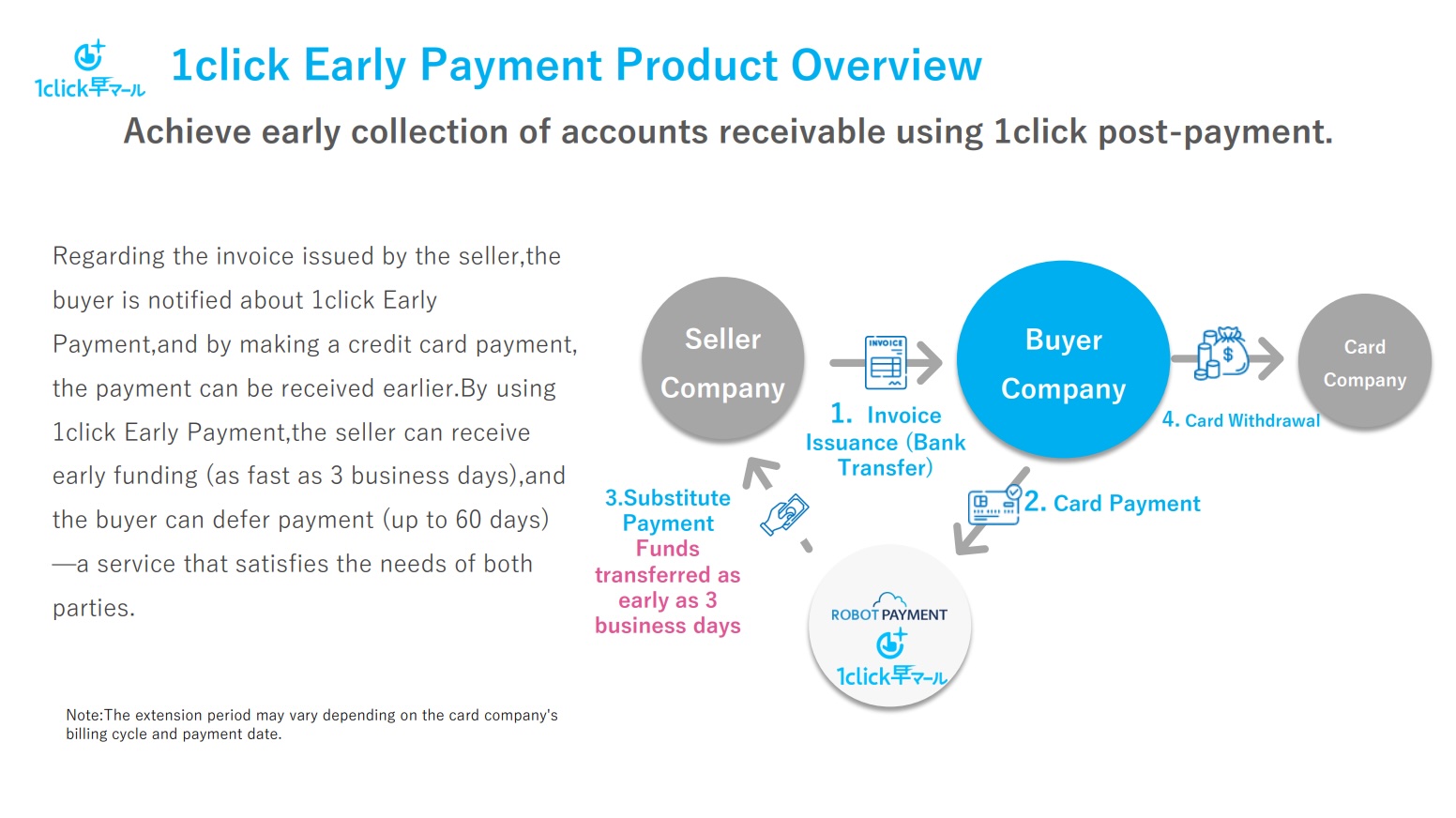

1Click Hayamaru

"1Click Hayamaru" is an early payment service that enables sellers to monetize accounts receivable

from issued invoices in as short as three business days.

When the buyer selects credit card payment via "1Click Postpay," the seller receives payment earlier

than usual, improving their cash flow.

As a BBPS (Business-to-Business Payment Service Provider), we act as a proxy for merchants, reducing

credit risk and eliminating the possibility of bad debt.

With no fixed costs, it is also suitable for one-time or occasional use.

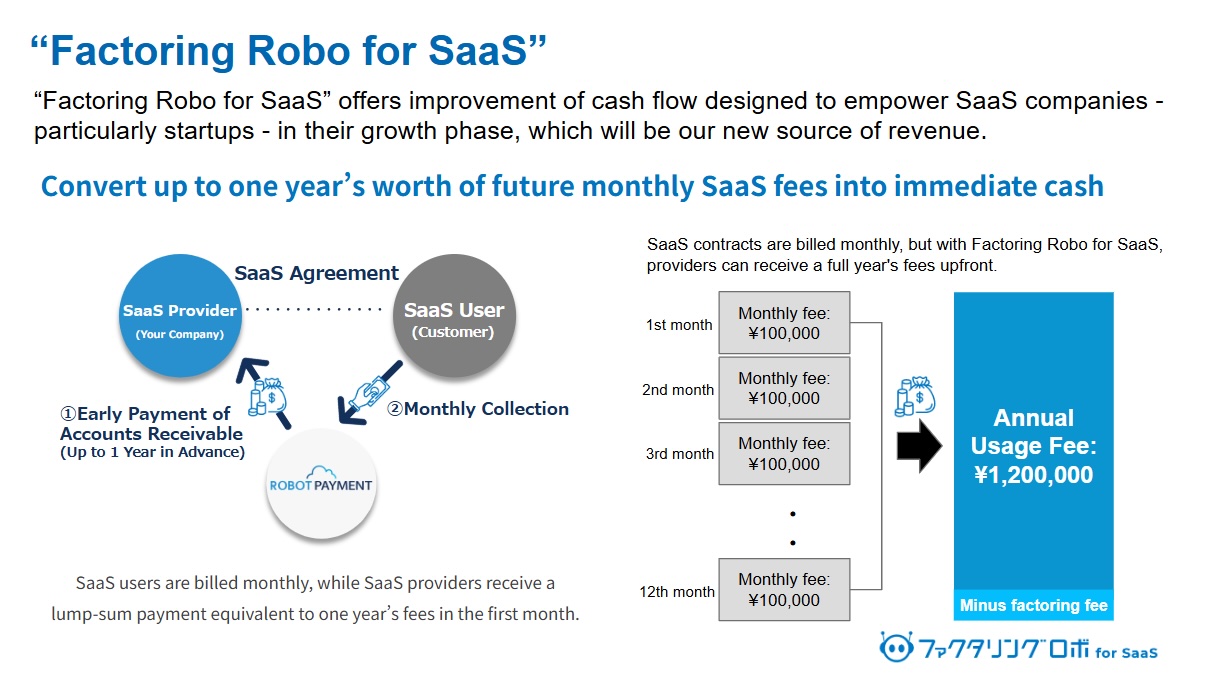

Factoring Robo for SaaS

"Factoring Robo for SaaS" is a fast-cash solution tailored for SaaS providers.

It enables monetization of up to one year’s worth of future monthly subscription revenues, ensuring

stable cash flow even in tight funding environments.

Leveraging our extensive expertise in payments and billing management, we offer end-to-end

support—from billing operations to credit evaluation and collection.

The process is simple, with flexible use starting from small receivables and no impact on sales

activities or client contracts.

It supports both startup cash flow needs and growth-stage investments, enabling fast and healthy

funding for advertising, hiring, and development—making it a strategic financing tool for growth.

3. Revenue Model Structure

We map the revenue models of each service provided by ROBOT PAYMENT based on billing structure and target segments.

scroll →

| Businesses primarily engaged in subscription-based services | Corporations conducting B2B businesses | Corporations and sole proprietors receiving invoices | Corporations and sole proprietors issuing invoices | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Pricing Structure | Description | Subscription Pay Standard |

Subscription Pay Professional |

Seikyu Kanri Robo | Seikyu Marunage Robo | 1Click Postpay | 1Click Hayamaru | Factoring Robo for SaaS |

|

| Initial Fee | Initial Implementation Cost | ◯ | ◯ | ◯ | ◯ | ◯ | |||

| MRR | Spread | Fees based on a commission rate applied to merchant sales | ◯ | ◯ | ◯ | ◯ | |||

| Fee | Usage-based fees according to the number of payment transactions | ◯ | ◯ | ◯ | ◯ | ||||

| Stock (Monthly Fixed Fee) | Fixed costs such as system usage fees | ◯ | ◯ | ◯ | ◯ | ◯ | |||

| Variable Fee | Volume-based fees for services such as mail outsourcing or billing processing volume | ◯ | ◯ | ||||||

4. Soundness of Equity Capital

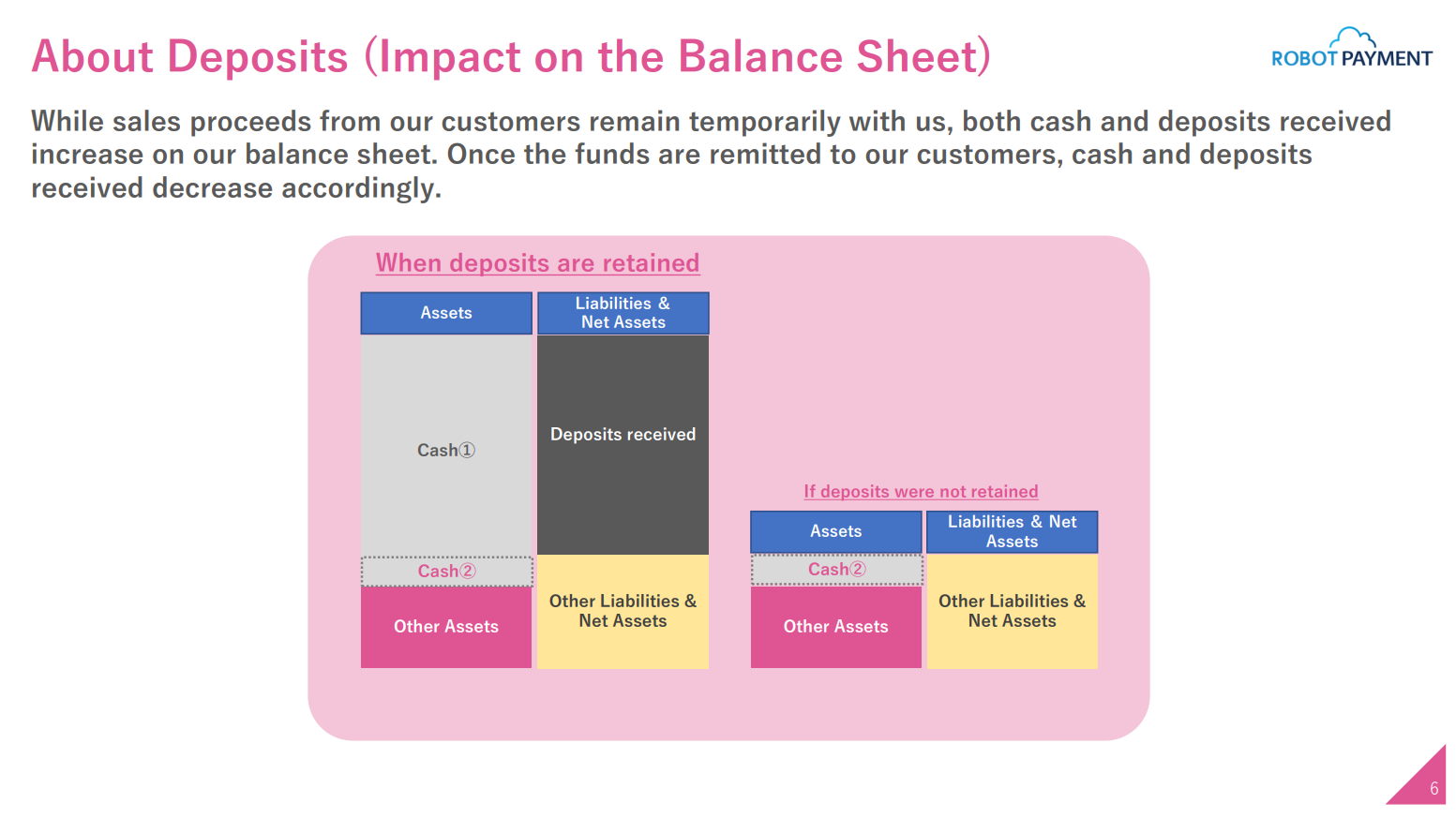

Regarding Deposits Received (Impact on the Balance Sheet)

In our payment processing business, sales proceeds from customer companies (merchants) are first

received by our company from payment service providers. These funds temporarily remain with us until

they are transferred to the customer companies.

Such temporarily held funds are recorded as deposits received.

During the period in which these funds remain within our company, both cash and deposits received on

the balance sheet increase. Once the funds are transferred to the customer companies, these items

decrease accordingly.

As a result, total assets temporarily increase, which may cause the equity ratio to appear lower on

the surface. This is a structural characteristic of our balance sheet.

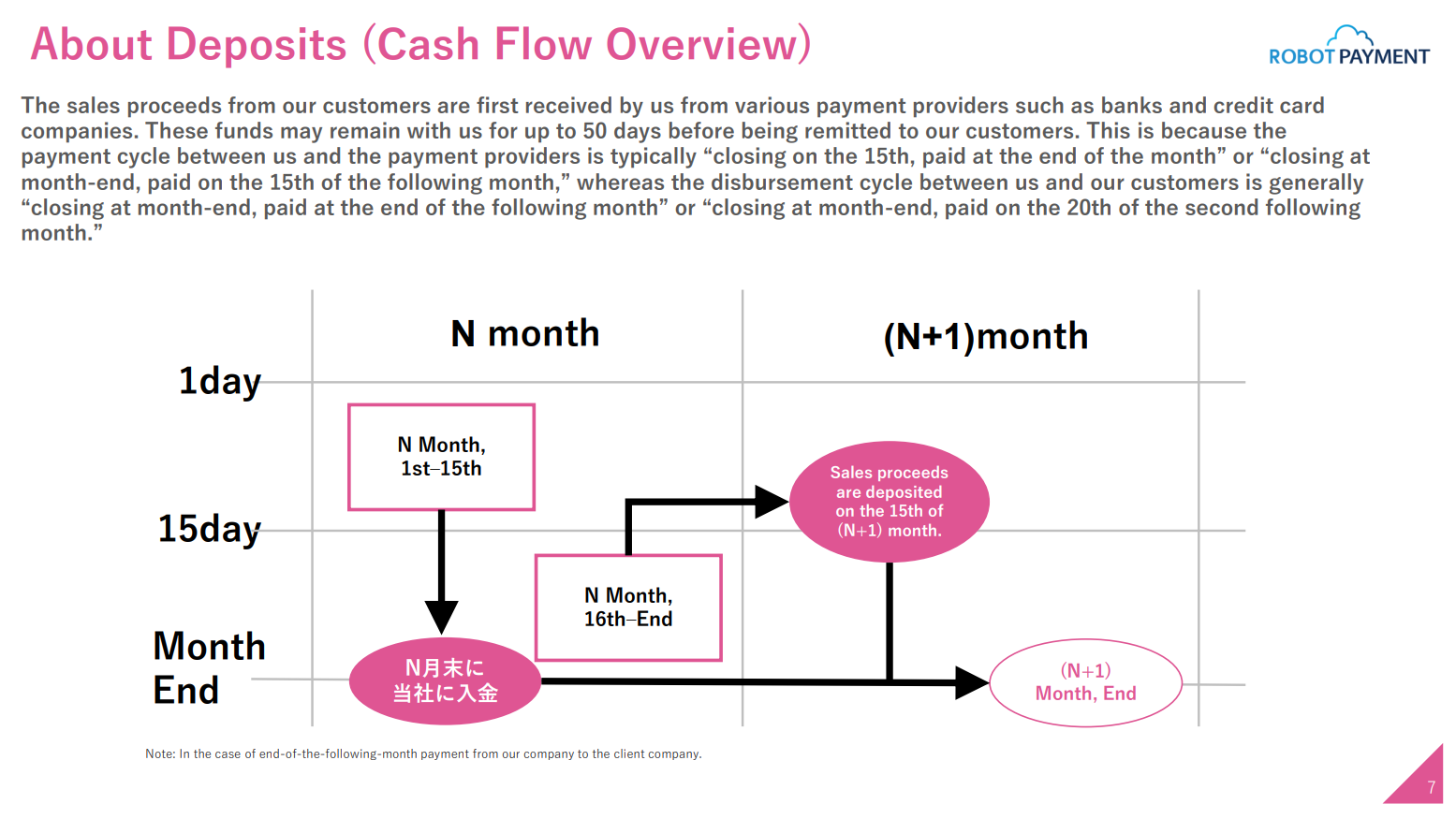

Regarding Deposits Received (Cash Flow)

Funds temporarily remain with our company based on a monthly cycle.

Due to the cutoff and payment cycles, funds may stay with us for up to 50 days.

Sales proceeds from customer companies are first deposited into our account by various payment

service providers, such as banks and credit card companies. These funds can remain with us for up to

50 days before being transferred to the customer companies.

This structure exists because:

- ・The incoming payment cycles between payment service providers and our company are typically:

- ・15th cutoff → end-of-month payment

- ・End-of-month cutoff → payment on the 15th of the following month

- ・Meanwhile, the outgoing payment cycles between our company and customer companies are generally:

- ・End-of-month cutoff → payment at the end of the following month

- ・End-of-month cutoff → payment on the 20th of the second following month

This timing difference results in temporary retention of funds within our company.

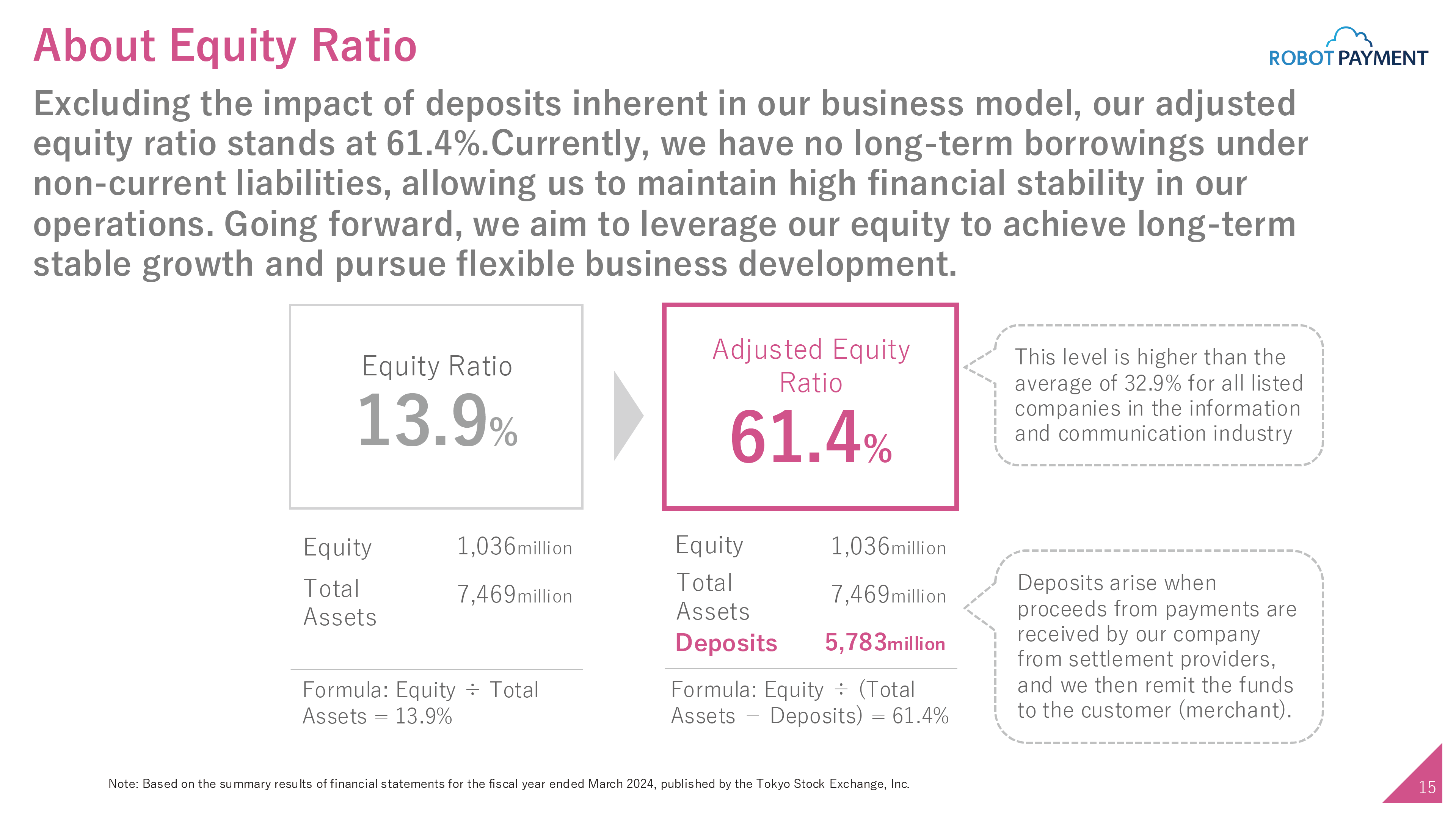

About the Equity Ratio

Our reported equity ratio is 12.7%, but when excluding deposits received, the adjusted equity ratio

stands at 65.0%, indicating a high level of financial soundness in substance.

The adjusted equity ratio of 65.0% is significantly higher than the average of 32.9% for all listed

companies in the information and communications sector.

Just as customer deposits are recorded as liabilities on a bank’s balance sheet, our business model

structurally generates deposits received.

This is a characteristic of operational flows in the payment processing business and does not

indicate any fundamental issue with our performance or business model.

Furthermore, we have no long-term borrowings recorded under fixed liabilities, reflecting an

extremely sound financial structure.

We are well-positioned to leverage our equity capital to achieve long-term, stable growth and pursue

sustainable business development going forward.