1. Corporate purpose statement

Our Strengths

ROBOT PAYMENT began offering internet payment services ("Subscription Pay") in the year 2000,

during the dawn of online payments.

While we faced numerous challenges and hardships along the way, we persevered with an unwavering

“where there’s a will, there’s a way” mindset, ultimately achieving our listing on the Tokyo Stock

Exchange Mothers (now Growth Market) in 2021.

In celebration of our 25th anniversary, we took the opportunity to reflect on how we can contribute

to today’s society, and we newly established our Corporate Purpose Statement—a declaration of our

commitment to solving social issues through our business activities.

At the same time, we also renewed our company vision.

Our New Vision

"Empowering Japan through a payment infrastructure that liberates commerce."

Japan's economy has been plagued by what is often called the "Lost Three Decades"—an extended period

since the early 1990s marked by persistent deflation, sluggish innovation, a lack of emerging growth

industries, and a declining working population due to demographic aging. These factors have all

contributed to a significant loss in the country's international competitiveness.

Against this backdrop, we at ROBOT PAYMENT are committed to addressing the three major barriers that

hinder commerce in Japan: customs, inefficiency, and credit.

Through our innovative financial services that connect money in new ways, we aim to break down these

walls and streamline the flow of money, enabling small to medium-sized enterprises (SMEs) and

essential industries in Japan to unleash their full potential.

By making transactions smoother and unlocking opportunities for new value creation, we will

contribute to strengthening Japan’s economic foundation and help create an environment where

companies can achieve sustainable growth.

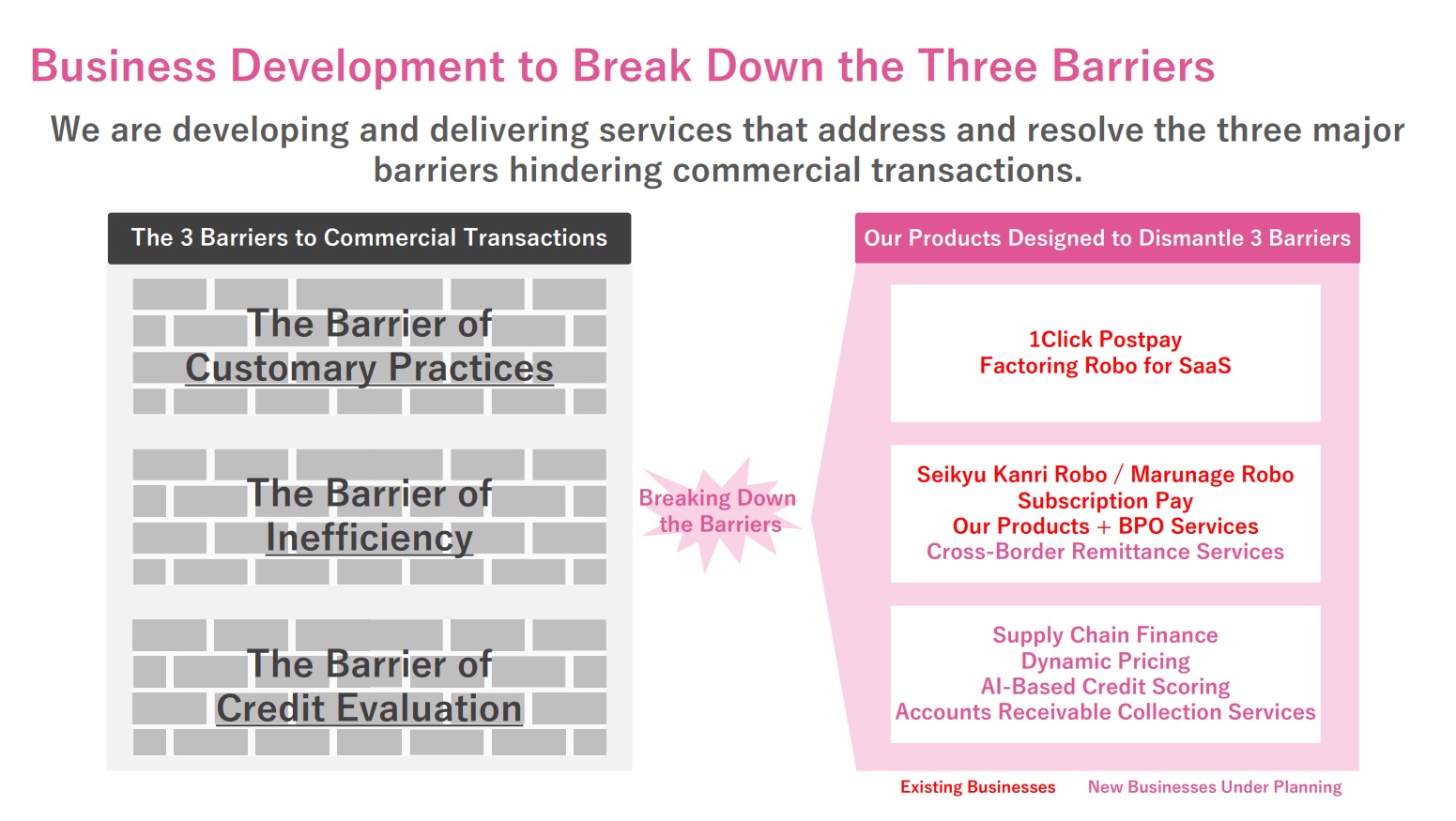

2. Business Development

Business Expansion Aimed at Breaking Down the Three Barriers

We are expanding our business to provide services that address and resolve the three major barriers hindering commercial transactions in Japan: customs, inefficiency, and credit.

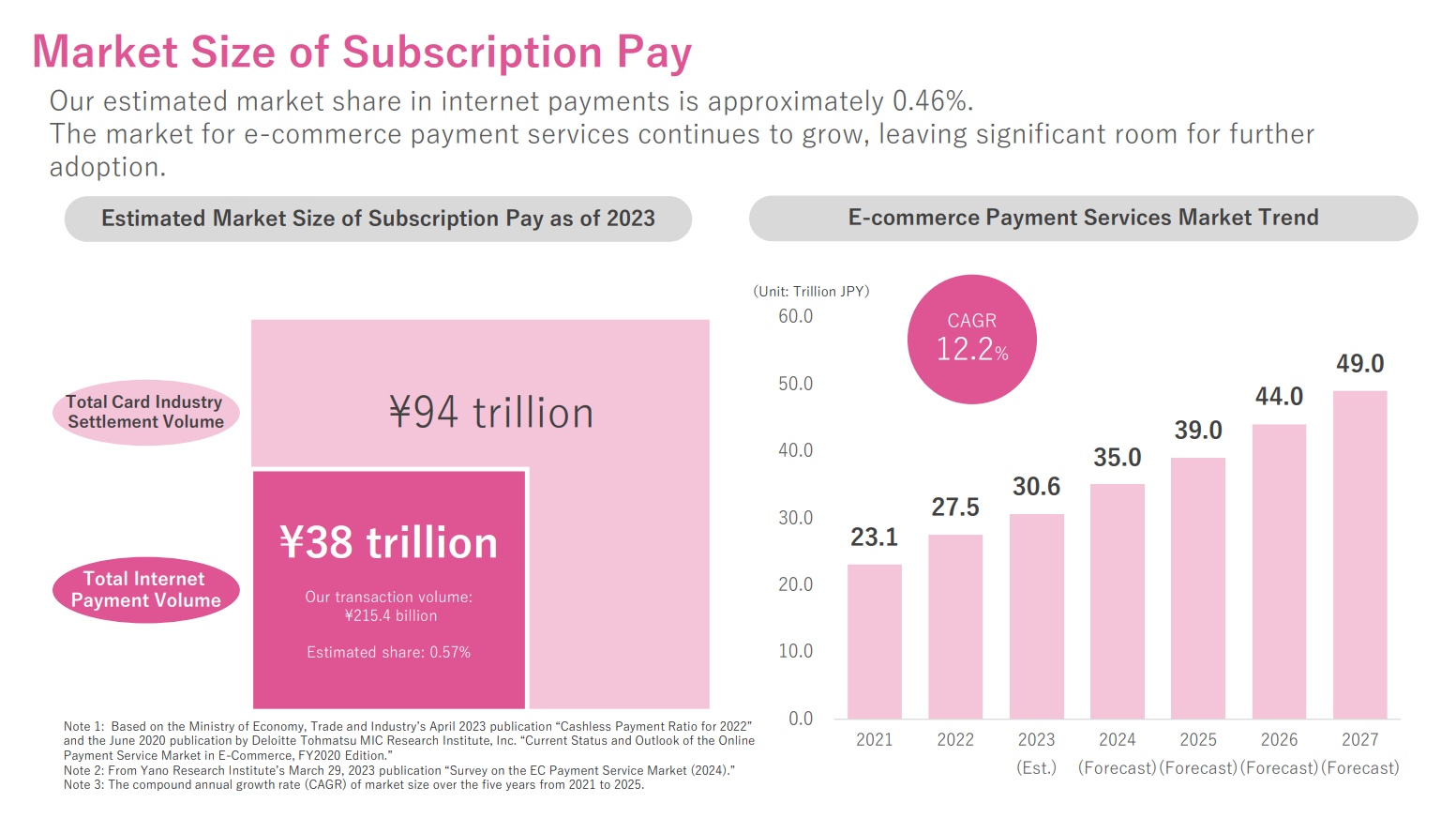

3. Market Size

Internet Payment Processing Service: "Subscription Pay"

The market size for our service "Subscription Pay" is estimated at ¥38 trillion, and the e-commerce

payment market is expanding with a CAGR of 12.2%.

The internet payment market continues to grow, and there remains significant room for us to increase

our market share.

In this expanding market, we aim to further promote adoption and accelerate our share growth.

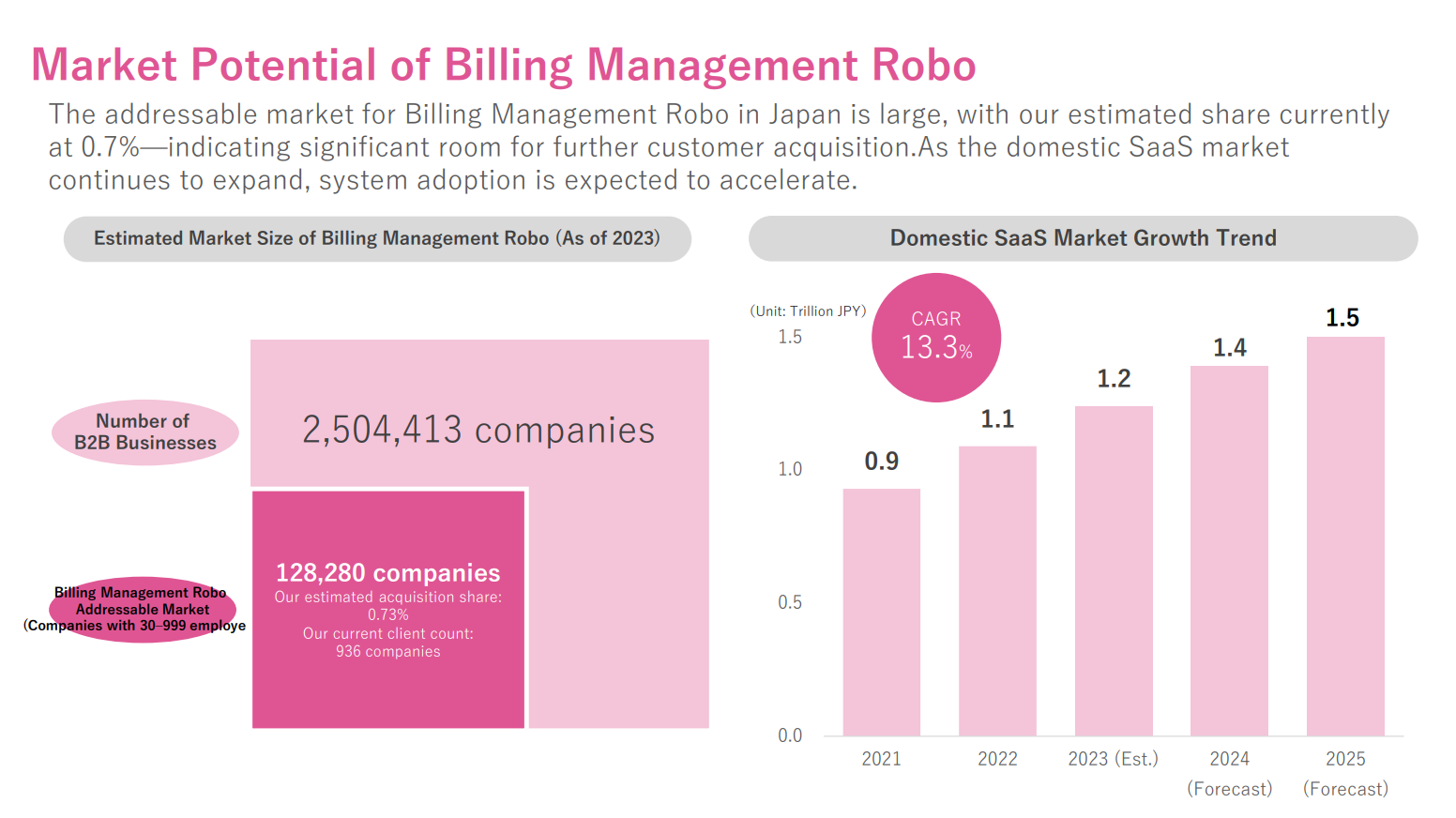

Invoice and Receivables Management System: "Seikyu Kanri Robo"

The domestic SaaS market continues to grow at an average annual rate of 13.3%, and there are over

2.5 million B2B companies in Japan that fall within the target market for Seikyu Kanri Robo.

Our current market share stands at only 0.7%, indicating significant growth potential.

As the implementation of the invoice system progresses, there is increasing demand for efficiency in

corporate billing operations.

We are accelerating product development for large enterprises and aiming to further expand our

market share.

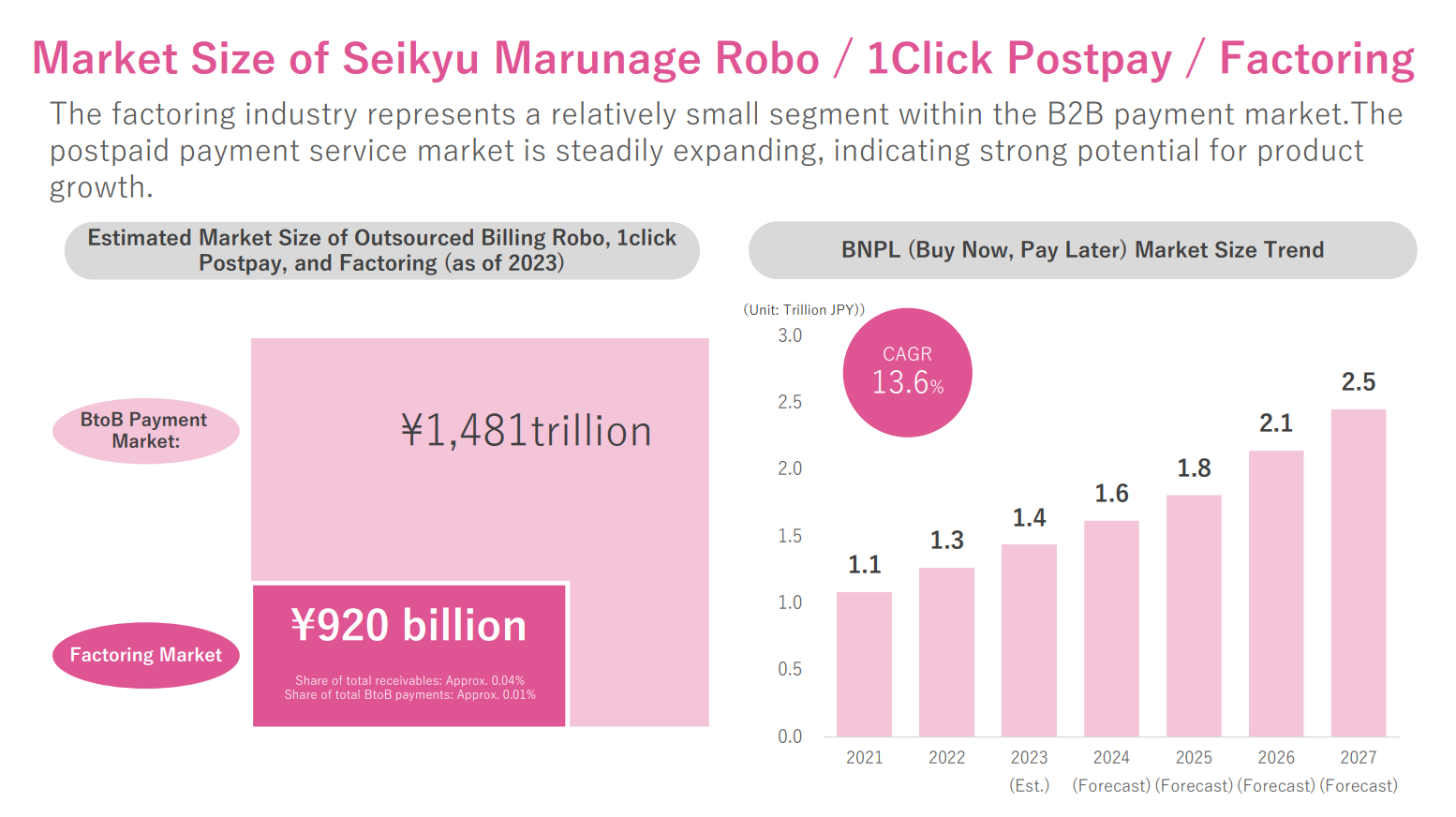

Factoring Services ("Seikyu Marunage Robo" / "Factoring Robo for SaaS") and Deferred Payment Service ("1Click Postpay")

Within the B2B payment market, the factoring industry currently remains relatively small at ¥9.2

trillion, but growing demand for cash flow optimization and financing support is creating

significant room for expansion in the future.

Meanwhile, the BNPL (Buy Now, Pay Later) market continues to grow at an average annual rate of

13.6%, and it is expected to become increasingly adopted as a payment method in inter-company

transactions.

ROBOT PAYMENT offers a wide range of products to drive transformation in the B2B payment

landscape:

- ・"Seikyu Marunage Robo" streamlines billing operations and supports cash flow management,

- ・"Factoring Robo for SaaS" provides SaaS businesses with fast and flexible access to funds,

- ・"1Click Postpay" enables deferred B2B payments using credit card transactions.

Through these services, we aim to accelerate innovation in the B2B payment market.

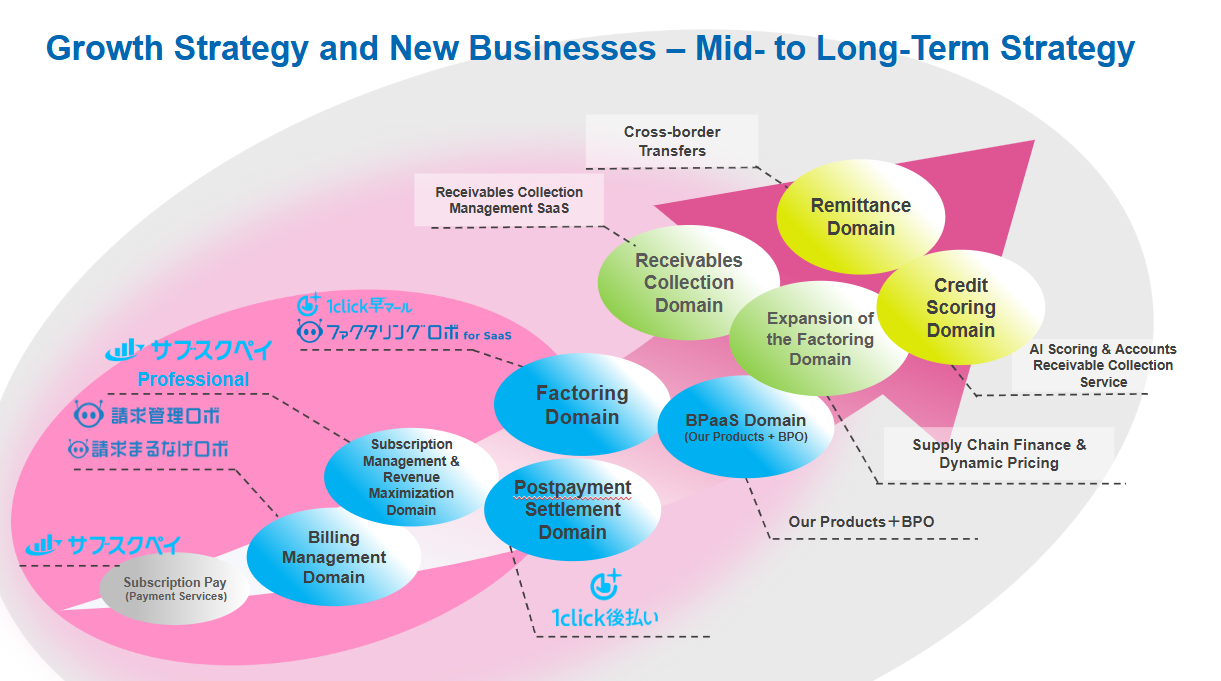

4. Medium- to Long-Term Strategy

As part of our future growth strategy, we will focus on “expanding businesses that break down the three barriers” as our central theme, driving further market expansion and entry into new domains. Further Expansion in the B2B Payment Market

- ・Expanding market share in internet payment processing services

- ・Strengthening capabilities in billing management, deferred payments, and factoring

Evolving Revenue Structure and Advancing Service Capabilities

- ・Offering Factoring Robo for SaaS, a factoring solution specialized for SaaS companies

- ・Expanding credit-based transactions and improving the accuracy of credit screening

Entering New Growth Areas

- ・Entering the international remittance market

- ・Providing supply chain finance and dynamic pricing solutions

- ・Developing accounts receivable management services utilizing AI-based scoring

Through these initiatives, we aim to build a payment infrastructure that enables smoother and more efficient B2B transactions, supporting the sustained growth of businesses.